Inflation & Why We Invest

Inflation erodes the purchasing power of your wealth. As the prices of goods inevitably increase over time, it takes more money for you to purchase the exact same amount of stuff. So if you don’t earn a return on your savings (thus overpowering the negative effects of inflation), you are really losing money in terms of actual purchasing power.

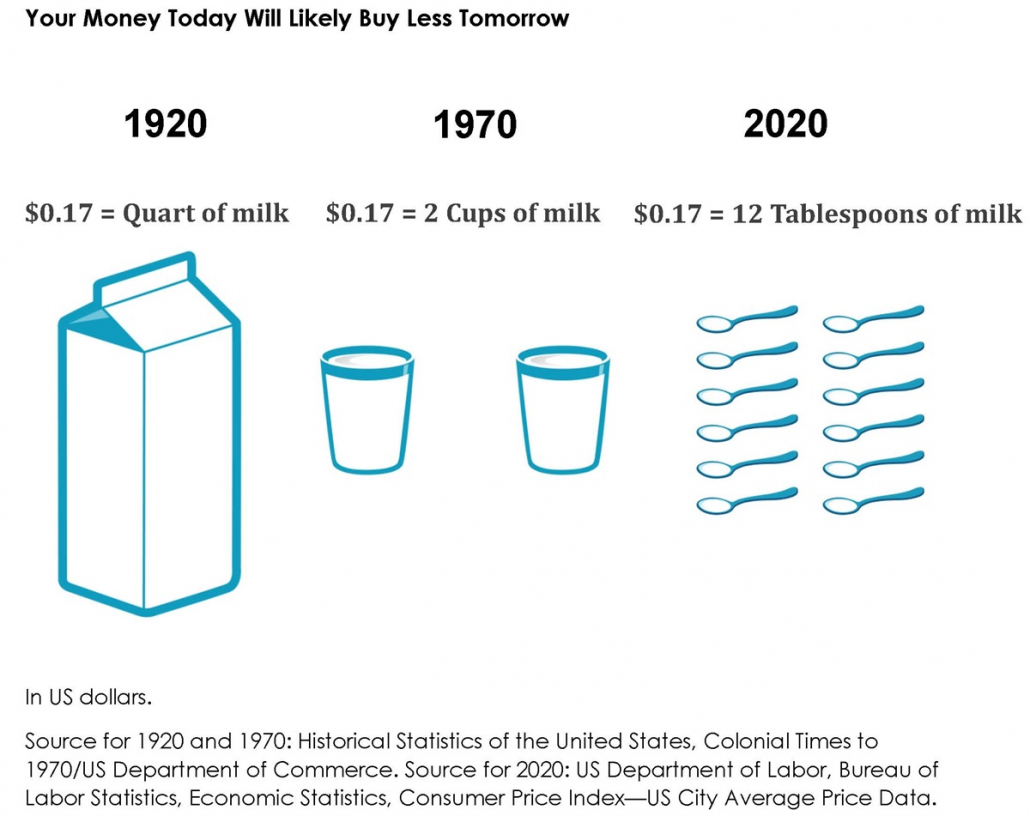

This is not just an academic exercise. To understand the real impact of inflation on your purchasing power, consider the illustration below. In 1920, 17 cents would buy you a quart of milk. Fifty years later, that same 17 cents would only buy two cups of milk. And 100 years later, 17 cents would only buy about 12 tablespoons’ worth! It’s as much “inflation” as it is “evaporation”!

So, as the value of a dollar declines over time (no-thanks to inflation), investing is a way to grow wealth and preserve purchasing power—mitigating the effects of inflation. As your financial advisor, we can help you weigh the impact of inflation and other important considerations when planning and investing for your future.

Adapted from an article by Dimensional Fund Advisors.

Client Login

Client Login

Leave a Reply

Want to join the discussion?Feel free to contribute!