Jelly beans

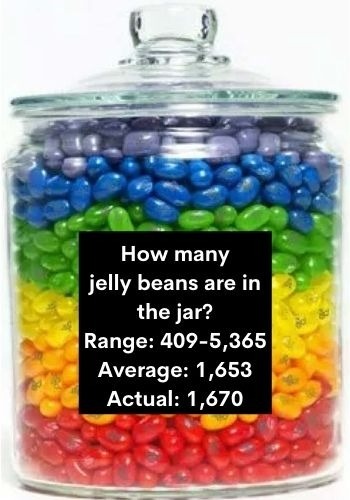

Ever try to guess how many jelly beans were in a jar like the one depicted above? This guessing game is similar to the way the market works, in terms of the average estimate of participants.

To make it clearer: In the illustration, we can see that when people are asked to guess how many jelly beans are in the jar, their answers are all over the map. But here’s the fascinating part: When you compare the average of all of the guesses to the actual number, it’s surprisingly close.

In other words, we know more, together, than we do as individuals. Pretty neat!

The stock market depends, heavily, on the collective feelings of investors. It’s very difficult, for example, to say what will happen on one given day, or to one particular stock. Every investor has feelings and estimates, so it’s hard to predict those answers.

But when we look at the market as a whole, there’s the integrated knowledge of all market participants—and remember that all of these participants have voluntarily agreed to make transactions. So, the daily prices in the market vary based on buyers’ and sellers’ expectations—and we can then accept the resulting prices as an accurate estimate of the current market’s value.

Client Login

Client Login

Leave a Reply

Want to join the discussion?Feel free to contribute!