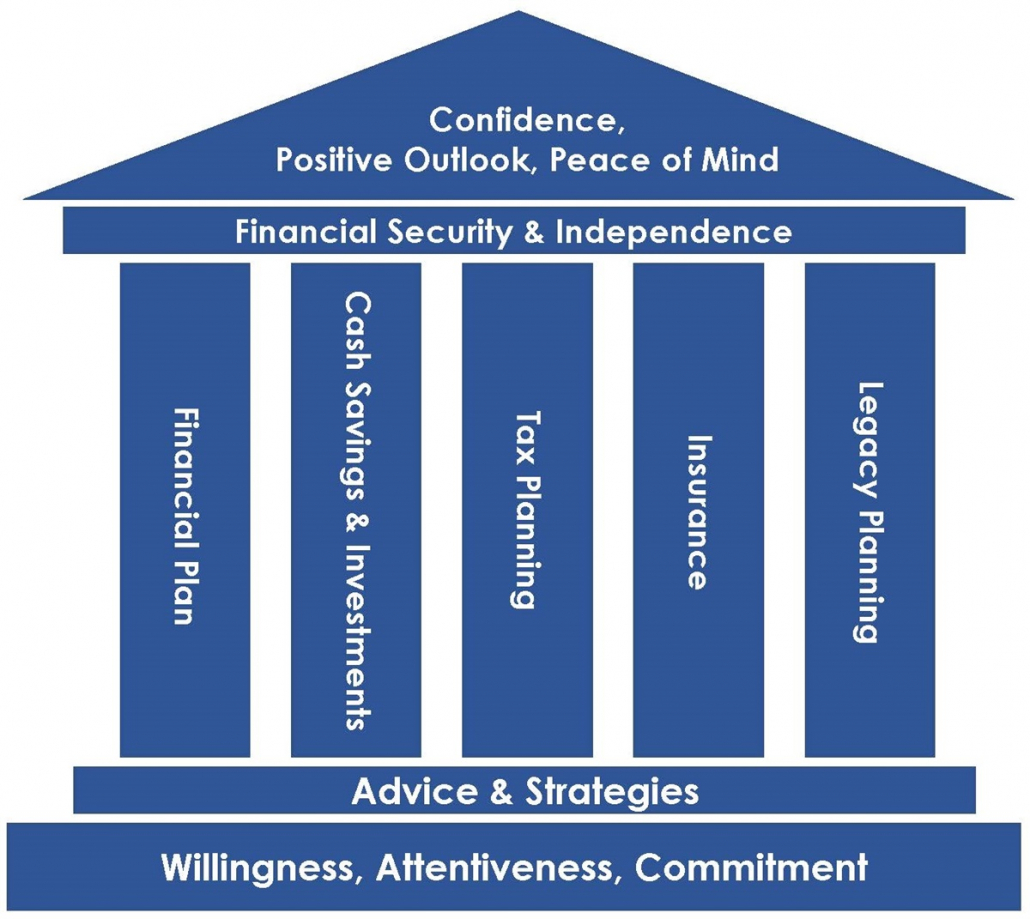

Your Five Financial Pillars of Success

When you think about your finances, what do you consider to be the most important areas? At Bridge Financial Strategies, we believe that building a stable financial house requires five solid pillars, constructed atop a secure foundation. So how do you do it?

Start with the Foundation: This essential element is “constructed” of your willingness, attentiveness, and commitment to having a stable financial house that you can build upon.

Add the Five Pillars: These include:

- Financial Plan. The financial plan is the overall strategy that helps you make good financial decisions for all the other pillars. Once your plan is in place, you can increase your confidence in attaining a secure financial future. The purpose of the plan is to help you make small changes in your spending and savings habits now, in order to give you a higher probability of success in meeting your financial goals in the future.

- Cash Savings and Investments. You need a good emergency fund, as well as a diversified and customized investment allocation that’s tailored to your personal risk tolerance.

- Tax Planning. You might be surprised to learn that taxes are among the biggest controllable variables in your financial life. Sure, you will pay taxes, but how much you pay is largely determined by the amount of effort you put into tax planning.

- While we at Bridge Financial Strategies don’t sell insurance (or any financial products), we know that having the right coverage, with the right deductibles, can make or break your financial plan. Whether it’s health, life, home, auto, umbrella, long-term care, or some other type of insurance, this pillar is critical to your financial success.

- Legacy Planning. Think of this pillar this way: A clear and current plan for your estate is your gift to your heirs. It saves them time (and stress) and helps to preserve the wealth you are transferring to them. Having your healthcare directives in place ensures that your wishes will be honored—and that you get to choose the person who will make your healthcare decisions for you.

As you can see in the graphic, your secure financial house will rest on its foundation and build upon its pillars. The desired result: have confidence, a positive outlook, and peace of mind about your financial future.

Client Login

Client Login

Leave a Reply

Want to join the discussion?Feel free to contribute!