My Favorite Time of Year

It’s April! So let’s talk about…

Christmas?

Stay with me here.

Christmas is definitely my favorite time of year. I love the lights. I love spending time with family. I love gift-giving. I also love the fact that, by Christmas, I will have wrapped more than presents. I’ll have also wrapped up my clients’ tax projections.

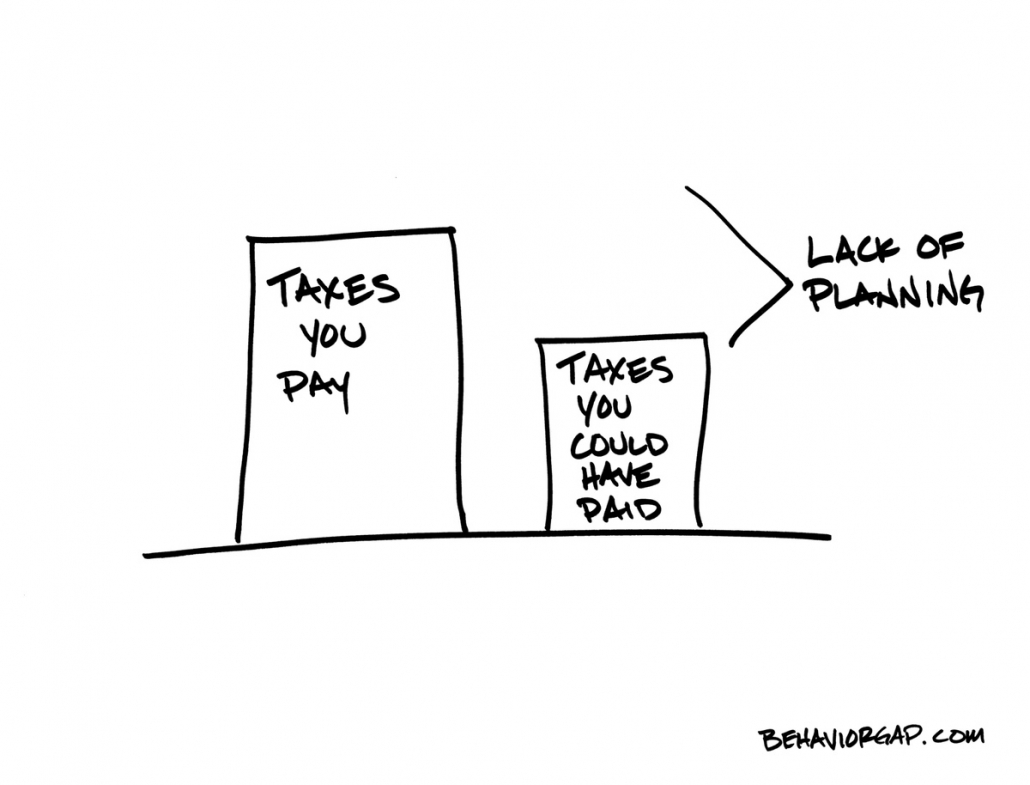

Each year, our firm estimates what our clients’ tax returns will look like in the spring. Then, throughout the year, we review tax strategies that will ensure a smooth and efficient tax-return outcome. By Christmas, all my tax projections are completed, so they can help our clients know what to expect in April. In other words, no big surprises.

Recently, I received a call from a frantic person regarding this year’s tax returns. They were trying to reduce their taxes so they didn’t owe so much. This call was fraught with “I wish I would have’s.” What you need to know is that there are ways to reduce your tax burden. However—and this is huge—you need to be proactive. You have to work with your tax professional before the end of the year.

Which leads to my second-favorite time of year (and the impetus for this holiday-themed note). It’s the day after tax returns have been filed. This is when our clients are ready to put in motion all the things that need to happen so that they are not surprised when they file their tax returns the following year.

For them, they’ve got peace of mind. For me, it’s like Christmas in April!

Client Login

Client Login

Leave a Reply

Want to join the discussion?Feel free to contribute!