The Super Bowl Indicator and Other Unusual Economic Theories

It’s a fun time of year for football fans. The NFL playoffs are starting, and the Super Bowl is just around the corner. While football fans will tune in for the matchups, commercials, and Usher’s Super Bowl halftime show, you may not realize that a segment of viewers will be watching the game to glean clues about the potential direction of the financial markets. These investors are looking for a nonscientific phenomenon known as the “Super Bowl Indicator.”

We thought it would be interesting to explore this and a few other out-of-the-box pseudo indicators. Keep in mind that these theories may not materialize based on the outcome of the Super Bowl. And any investment should be consistent with your objectives, timeframe, and risk tolerance.

What Is the Super Bowl Indicator?

The National Football League (NFL) has been around since 1920. In 1960, the rival American Football League (AFL) formed. After ten years of competing for fans, the two leagues merged under the NFL moniker in 19701.

The Super Bowl Indicator is the theory that if a pre-merger NFL team wins, that can be a positive for the stock market, as measured by the Standard & Poor’s 500 Composite Index. However, if a former AFL team takes the Lombardi Trophy, that may foreshadow bearish conditions ahead2.

Although decidedly nonscientific, this indicator has somehow endured for decades among those who believe big game outcomes eerily align with market moves. Rather than to earnings, rates, and risks, these superstitious people might look to the results from Allegiant Stadium on February 11 as a predictive barometer.

Where Did the Super Bowl Indicator Come from?

The Super Bowl Indicator was introduced in 1978 by Leonard Koppett, a sportswriter for The New York Times. When he came up with it, his Super Bowl Indicator had never been wrong.

As prescient as it was up to that point, Koppett added one major caveat to his indicator that helped his odds. He put the Pittsburgh Steelers, a team with an NFL-leading six Super Bowl wins, in the NFC. His logic was that the team started back in 1933 as an original NFL franchise, even though it won all its Super Bowls as part of the AFC.3

How Has the Super Bowl Indicator Done at Predicting Stock Market Returns?

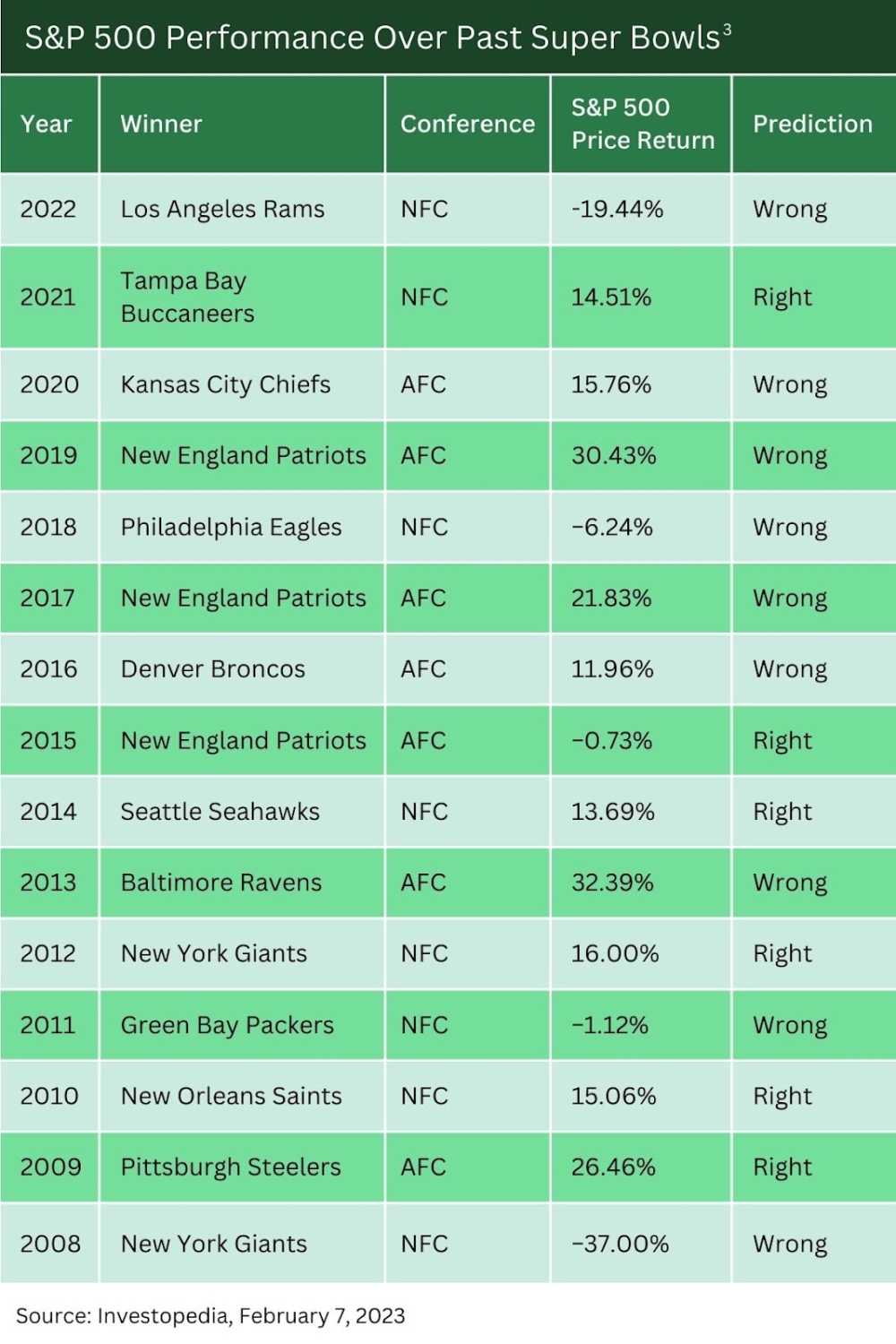

Overall, the results of the Super Bowl Indicator have had a slightly better-than-average track record. Since its introduction in 1978, the Indicator has been right roughly 70 percent of the time3.

But, as the chart below indicates, Koppett’s theory hasn’t had such a stellar record since 2008. It seems the Super Bowl didn’t predict major world events like the Great Recession or the COVID-19 pandemic.

There Are Plenty of Other Strange Indicators Out There

Besides the Super Bowl Indicator, there are several other quirky indicators that certain people have followed over the years.

The Cardboard Box Indicator

The Cardboard Box Indicator is based on the fact that nearly everything is shipped in a cardboard box. This indicator points to the strength of the economy. High demand for cardboard boxes means more economic activity is happening. Just think of all those Amazon boxes outside your door.

Less demand for cardboard indicates a less robust economy. Rumor has it that famed Federal Reserve Chairman Alan Greenspan may have glanced at this indicator to gain insight into manufacturing performance.

Cardboard box watchers point out that in 2008, at the height of the recession, revenue of cardboard box manufacturers averaged a 50% drop4.

The Big Mac Index

The Big Mac Index compares the cost of a McDonald’s Big Mac in over 50 countries. The theory operates on the premise that the same item should cost essentially the same everywhere.

As a result, if you compare the price of a Big Mac using exchange rates, you can see if a country’s currency may be overvalued or undervalued. The Economist first developed the Big Mac Index in 1986 and maintains an interactive index on their website.4

The Christmas Price Index

Many indices measure inflation rates, but one of the most unusual is the Christmas Price Index. Created by PNC Bank, it focuses on the items found in the lyrics of “The Twelve Days of Christmas.”

PNC traditionally goes to Petco for the price of canaries (calling birds), Gordon’s Jewelers for golden rings, and the Cincinnati Zoo for rates on partridges, turtle doves, and French hens. The index has revealed interesting trends over the years, including fluctuations in labor prices.5

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of securities.

Taking a Long-Term Perspective

As financial professionals, we are here to help our clients build portfolio strategies based on their goals, time horizons, and risk tolerance. We focus on creating a sound financial approach and avoid being influenced by superstitious theories.

Our job is to create roadmaps that help our clients pursue their short-term and long-term objectives. So enjoy the big game, but avoid reading anything into the final score!

- Britannica.com, October 28, 2023

https://www.britannica.com/topic/National-Football-League - The Chicago Financial Planner, February 7, 2023. The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

https://thechicagofinancialplanner.com/the-super-bowl-and-your-investments/ - Investopedia, February 7, 2023

https://www.investopedia.com/terms/s/superbowlindicator.asp#toc-what-is-the-super-bowl-indicator - The College Investor June 19, 2023

https://thecollegeinvestor.com/1666/weird-stock-market-indicators/ - PNC.com, November 14, 2023

https://www.pnc.com/en/about-pnc/topics/pnc-christmas-price-index.html

Client Login

Client Login

Leave a Reply

Want to join the discussion?Feel free to contribute!